Research & Analytics

Crypto Markets have high volatility?! - March 2022

If we are talking about Bitcoin and other crypto assets we hear a lot concerns about high volatility in this new asset class.

But, what means “high volatility” and how can we compare it ?

In finance, volatility is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns.

In most cases, the higher the volatility the riskier the security

But how can we compare Crypto volatility? Do we compare it with FX, commodity or stocks ?

Stocks are trading only on business days with daily trading hours. Bitcoin is available 24/7/365. FX can be traded in a comparable way.

Lets compare Crypto Assets with traditional stock markets.

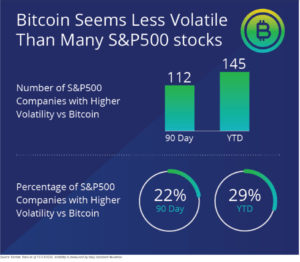

In a long-term study of bitcoin, Van-Eck analyzed the correlation bitcoin and traditional asset classes and came up with an interesting result, which may surprised researcher and investors. They analyzed the 90 day and YTD volatility of Bitcoin against the constituents of S&P 500 Index and find out that Bitcoin has a lower volatility than 112 stocks of the S&P 500 in a 90 day period and 145 stocks in YTD.

In January META (former Facebook) crashed more than 20% in a single day after announcing bad numbers. End of last Year we had sharp moves into same direction in BTC where the prices declined by more than 20 % intraday as well.

As always it is the most critical question “What do you compare with each other?”. Market Cap, Trading Size, regulatory boarders and general limited access into markets are some factors to keep in mind. But correlation and volatility are combined and higher volatility means higher risk but potentially also higher returns, either on crypto or capital markets.

If you have any questions about #volatility #blockchain pls send a message at info@globalblockchain.ch

Your R & A Team

Traditional Industry vs. Metaverse - Feb 2022

The metaverse will be a part of the next iteration of the internet. Also known as Web 3.0 it is the vision of a decentralized and user controlled online-ecosystem based on blockchain technology.

Within the next years it will change everything we know so far, we will play, work, invest and socialize not only in the “real” world, we will spend time and money in a digital virtual universe to attend professional conferences at virtual hotels, we will shop new sneakers for our avatar to create a digital identity of ourself.

Let`s have a look how the future could look like in 2030 (and I assume the development will be faster)

You will strap on your virtual reality headset and meet your friends in metaverse in their house which they created on their own land (which they bought on Sandbox or other providers) and for sure will be a good guest and buy a welcome gift (maybe an art NFT) which they can present in their lobby. On the weekends you will go for a round of golf on a digital golf court, where you own a part of the land and you receive a fee, like a lease income in the “old economy”. You will spend some money in the virtual golf store to buy a new fancy Golf bag for your avatar, which is unique and represented by an NFT. Next time you will visit an e-gaming conference and donate some of your rewards for your preferred player. Several well-known corporates will do marketing and advertising on the golf court, e-gaming events and the large virtual cities you are living in, just like in the “real” world.

For people born in the last century (as myself), it might be hard to imagine and realize but the borders between the real and virtual life will blur.

But, let`s look back 30 years when internet was launched. Wasn`t it the same situation for our parents? Didn`t a lot of them say, “What is the internet? In 5 years no one will speak about it anymore.”

During this time period a lot of new companies like Facebook, Google, Amazon or Netflix., started their success story.

A lot of new projects are now starting their business in the metaverse, but for sure it doesn`t mean that the traditional once will die, but might have to adapt to do a hybrid strategy, investing and operating in both worlds. Right now, there are already activities from well-known corporates like Adidas, Samsung or Microsoft but also Brands as Snoop Dogg to start their second life in metaverse, with totally new revenue streams which were not existent before.

Is it good or bad? That’s more a philosophical question. I prefer to go out into the real forest to climb real mountains and go for skiing to breath fresh air, but if I look at the younger generation I am not so sure about it. It will be a mixture of both and it will be interesting to see how new players will enter the market and how traditional once will change their focus to be part of a potential multi trillion dollar market.

If you have any questions about #metaverse #blockchain pls send a message at info@globalblockchain.ch

Your R & A Team

SOLO Airdrop - Review - Jan 2022

As we mentioned in our last report, SOLO distributed 200 Million Token in an airdrop with a snapshot on December 24th 2021. 200 Million token represent 50% of the total supply.

What was happened after the snapshot ?

Directly after the snapshot SOLO plunged by 50%.

There is no free lunch. Given the airdrop tokenomics, the low liquidity on only some small exchanges and the missing shorting opportunities consequently results in such price moves. XRP holders could also participate in the airdrop but with a way smaller ratio. Therefor XRP price droped as well and we could see an increase in borrow rates in the days before x-mas.

Equity trading vs. token Airdrop

Are there some similarities ?

If a listed company issued bonus shares in a ratio 1:1 we will see the same result in economics. Double number of shares will result in reduction of the stock price by 50 %,

ceteris paribus. As we could see in SOLO airdrop, the effect was pretty much the same.

What`s different ?

- In the traditional equity world the shareholder will not need to take any actions as the Bank, Exchanges and Clearinghouses will deliver the bonus shares or execute or sell your subscription rights and book the money for you.

- For crypto currencies you will have to do your own research and manage your wallets and set the trustlines (XRP) yourself or select your custodian carefully if they support these services for you. Otherwise you will not receive the airdrop but you will fully participate on the price drop.

- Exchanges, custodian or wallet provider do not necessarily support airdrops.

- If you need support with this research and selection of custodians please contact us under info@globalblockchain.ch We can help you!

What was special on SOLO ?

Starting end of October we could see a massive price move in SOLO token starting from 0,10 USD and ending up in an all time high of nearly 7 USD by beginning of december. So we could see a price increase by factor x70 !!

On the one hand side the expectation of a “free” airdrop could motivate people to buy the token, on the other hand side the missing liquidity and a listing at only smaller exchanges had been a catalyst for this price move.

One special topic on this airdrop was the fact, that the token was listed already and there was a market price. If an airdrop will be distributed first time without a listing, the token doesn’t have a price, which makes a big difference for investors living in countries where they have to pay taxes on this transactions. In the case of SOLO, the investor may have to pay taxes on the airdrop value based on the price at the time of the snapshot. With the large price drop after the snapshot, he might end up with a loss after taxes.

If you have any questions or want to receive more information about our research & analytics pls contact us info@globalblockchain.ch

Your R & A Team.

Air Drop on SOLO - Dec 2021

Right for the X-mas party… SOLO will distribute 200 Million Token in an Airdrop for all SOLO and XRP holders. Meaning the total airdrop would be worth around 0.5 to 1 billion at time of writing.

The snapshot will be taken on December 24th 2021 at 8:00 PM UTC. Eligible holders will receive the rewards on January 20th at 8:00 PM UTC

Check out with your custodian if they support the airdrop.

For all Banks, Asset Managers and institutional clients who need support with the selection of the right regulated custodian, contact us – we will help you !

https://airdrops.io/sologenic/

In our next Research & Analytics report we will have a closer look into the SOLO airdrop and how the distribution affected the price.

Are there any comparable scenarios on the traditional investment banking world? Stay tuned….